What is Coinvest

Coinvest is a decentralized share exchange that allows users to invest in a very simple set of cryptoes. When a user wants to trade, Coinvest Token (“COIN”) is sent to the contract along with a list of the sacrificed assets that the user wants to invest. The amount and price of the purchased asset are recorded in USD and when the user wishes to liquidate their ownership, they follow the same sales process with selected assets and their address is returned COIN in USD earned value. This will all be handled through the easy-to-use Coinvest frontend so that anyone can now invest in emergency crypto.

Centralized third parties, whose services are often required in the case of traditional investments, will be replaced by smart contracts that act as stand-alone agents and at the program level compensate all users, investors and owners in the Coinvest ecosystem.

Advantages of using Coinvest

Simplicity

Investing in crypto assets is an extremely complex process today. The exchange requires the authorization of KYC, which can take hours (if not days) for verification. Coinvest legally bypasses the KYC process, since there is no currency in the currency, assets, and since the franchised contract Coinvest is the custodian of your deposited funds.

Convenience

Safe storage of crypto assets is mandatory, but not trivial. Some coins and tokens have different standards and require different purses. As a consumer, you need to choose between different options for the wallet (for example, hot, cold, paper, etc.). Depending on your appetite for risk. With Coinvest there is no storage of investment assets, since all portfolios are completely digital.

Safe storage of crypto assets is mandatory, but not trivial. Some coins and tokens have different standards and require different purses. As a consumer, you need to choose between different options for the wallet (for example, hot, cold, paper, etc.). Depending on your appetite for risk. With Coinvest there is no storage of investment assets, since all portfolios are completely digital.

Functionality

Prices in crypto-currencies can be extremely unstable. Acquisition of assets at the wrong price and time can be a difference in profit or loss. Currently, there are limited investment options that allow users to perform flexible purchase options, such as short and price limits. Coinvest is one of the first in the industry to offer this functionality.

Prices in crypto-currencies can be extremely unstable. Acquisition of assets at the wrong price and time can be a difference in profit or loss. Currently, there are limited investment options that allow users to perform flexible purchase options, such as short and price limits. Coinvest is one of the first in the industry to offer this functionality.

Diversification

Unlike current exchanges, Coinvest offers index funds containing a portfolio of cryptonalized assets associated with components such as market capitalization, industry, etc. Index funds allow users to invest without individual and active asset purchases. Meanwhile, providing a broad market risk, low operating costs and a low portfolio turnover.

Unlike current exchanges, Coinvest offers index funds containing a portfolio of cryptonalized assets associated with components such as market capitalization, industry, etc. Index funds allow users to invest without individual and active asset purchases. Meanwhile, providing a broad market risk, low operating costs and a low portfolio turnover.

Autonomy

There are currently no investment vehicles that allow investors to invest in the index of crypto assets created by themselves. Current investments, the index and mutual funds are managed by third-party asset managers and do not provide flexibility and control of the fund itself. Personal index funds at Coinvest give users the ability to control assets.

There are currently no investment vehicles that allow investors to invest in the index of crypto assets created by themselves. Current investments, the index and mutual funds are managed by third-party asset managers and do not provide flexibility and control of the fund itself. Personal index funds at Coinvest give users the ability to control assets.

Decentralization and security

Investing in cryptothermins requires sending funds directly to the exchange or investment fund (which in its essence creates centralization and high risk, because they are the custodians of your funds). Coinvest does not accept any funds (fiat, crypto currency, etc.) or payments directly from users. User funds are stored in escrow and are controlled by the standalone Coinvest bot (computer code) under the intellectual contract in the Coinvest protocol. Users can withdraw funds or close their positions at any time and automatically receive distributions through the Coinvest smart contract. The Coinvest investment process does not require human participation or interaction.

Investing in cryptothermins requires sending funds directly to the exchange or investment fund (which in its essence creates centralization and high risk, because they are the custodians of your funds). Coinvest does not accept any funds (fiat, crypto currency, etc.) or payments directly from users. User funds are stored in escrow and are controlled by the standalone Coinvest bot (computer code) under the intellectual contract in the Coinvest protocol. Users can withdraw funds or close their positions at any time and automatically receive distributions through the Coinvest smart contract. The Coinvest investment process does not require human participation or interaction.

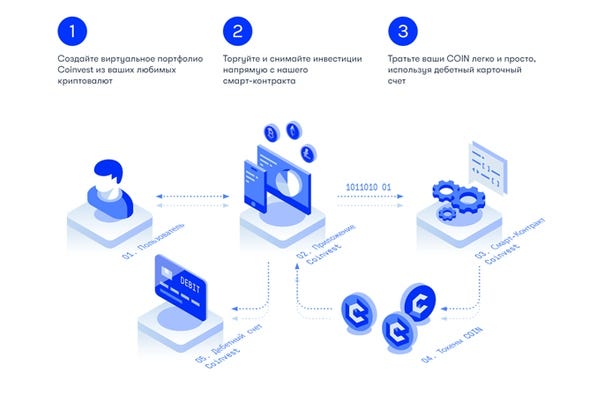

How it works

Benefits

- *Trade awards / Receive COIN rewards for each transaction on the Coinvest platform.

- *Super Trader / Profit from transactions in your virtual investment portfolio

- *Fund Management / Receive 50% of commission income from users who invest in your personal fund

- *Valuation / Platform selection, transaction volume and redemption increase the value of COIN

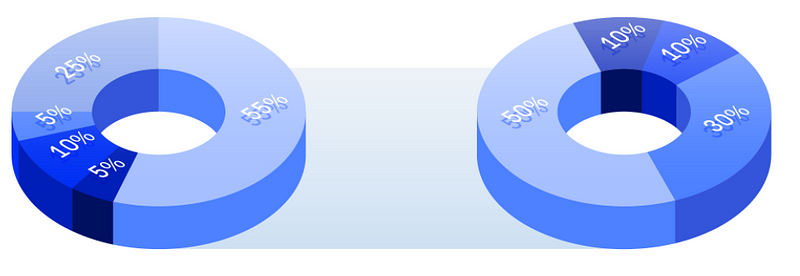

Distribution of tokens

- Pre-ICO 11.12–31.12 | ICO January 2018

Price of the token on the ICO 1 ETH = 300 COIN - COINVEST BOUNTY

- In this case coinvest reward to anyone who follow bounty campaign. Coinvest provides 300,000 COIN for this bounty campaign. Distribution will be shared, the pebagian is as follows:- Campaigns on social networks: 40% (120,000 tokens)- Signature and Avatar: 20% (60,000 tokens)- Communication Campaign: 15% (45,000 tokens)- Content campaign: 10% (30,000 tokens)- Reward for finding bugs: 15% (45,000 tokens)Complete payout for bounties (token distribution) will be made no later than two weeks after the end of crowdsdale. Bounty will be divided among participants according to their number of stakeholders. Users must have ETH ERC20 wallet to receive COIN marks.The total number of pools is 300,000 COINs. If the Coinvest crowdsale does not achieve the minimum goal of 1M USD (3,333 ETH), all COIN tokens will automatically be destroyed by the smart contract, and the bounty will be considered invalid.After crowdsdale, bet data will be calculated and distributed according to the following schedule:- First quarter after crowdsdale end — 25%- Second quarter after crowdsdale end — 25%- Third quarter after crowdsdale end — 25%- Fourth quarter after crowdsdale end — 25%Such a payment system is created as a protection against COIN depreciation, preventing mass sales when COIN enters the stock exchange. It also ensures that bonus participants have a good chance to monitor the company’s development during the first year.BOUNTY DISTRIBUTION FORUMRUMUS: Formula (Number of Bounty tokens / Bounty bet amount) * stakeFor example, if you participate in a bounty campaign on social media and get 50 stakeholders, and the bet amount is 2364 bets, how to calculate it is as follows:(120,000 coins / 2364 bids) * 50 bets = 2538 COINFor more info:Author: kimokimoBitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1369201ETH address: 0xB04FCeb34ADE6bE9d6afD0f80AC7BF9Bb2a429C2

No comments:

Post a Comment